Rankings

- You can integrate with Appsflyer by sending Leanplum a postback containing publisher information. This allows you to view attribution data in Leanplum analytics as well as use it for targeting in A/B tests or marketing campaigns, via Leanplum’s targeting and segmentation menu. Before you activate th.

- If you already use an external mobile install tracking service, such as Kochava (a preferred Unity Asset store partner), AppsFlyer, Adjust, or Mobile App Tracking by Tune, you can easily configure attribution tracking links in Unity Ads to notify your install tracking service of the views (or clicks), then configure a Unity Ads postback URL in.

The AppsFlyer Performance Index only includes media sources that met strict conditions on two fronts:

- Volume: Based on client adoption and the number of attributed installs, both on a per-platform, region and category level (where applicable).

- Fraud: Based on a fraud rate threshold that was calculated per region and per category (a detailed explanation appears in the fraud section). AppsFlyer’s scale in the market enables us to provide the most accurate impact of fraud on the performance of media sources.

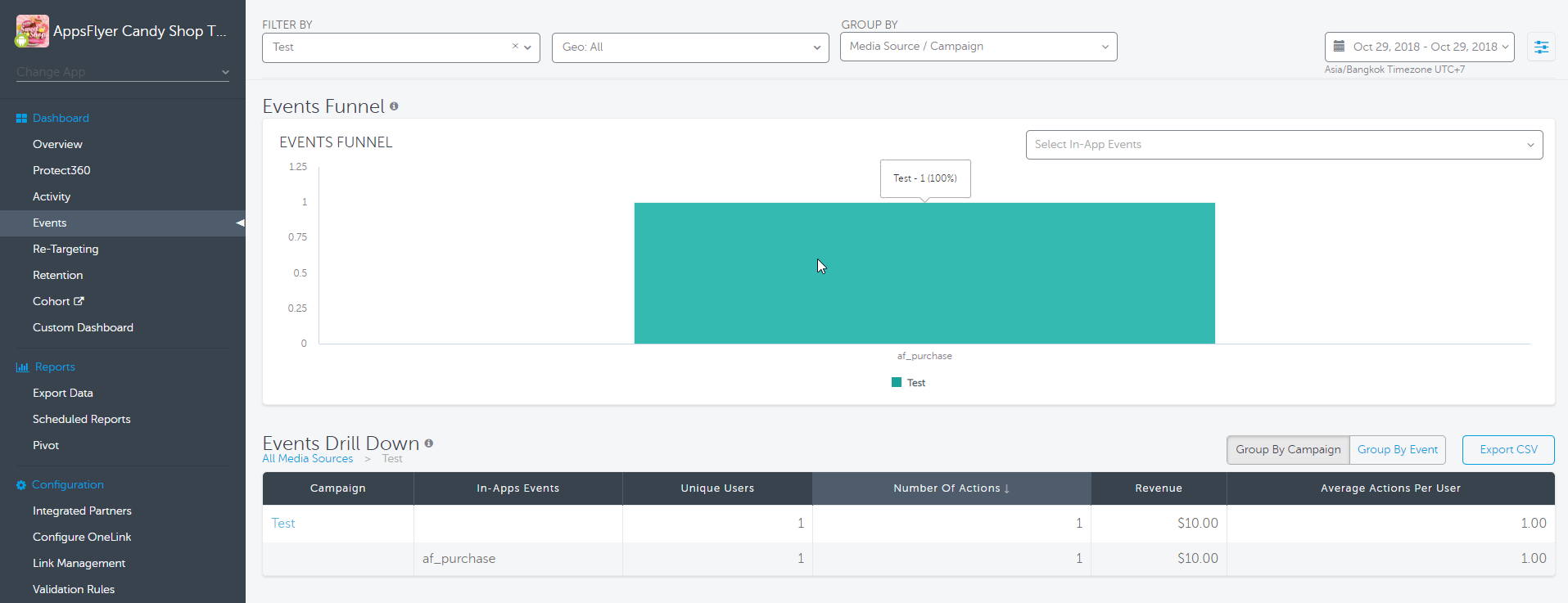

I have setup project game analytic using AppsFlyer in Unity like this: But the data can't show on AppsFlyer overview after release on Google Play Press J to jump to the feed. Press question mark to learn the rest of the keyboard shortcuts. (AppsFlyer / Unity IAP package) AppsFlyer in-app purchase event - incorrect revenue values are shown in the AppsFlyer console. Ask Question Asked 6 months ago. Active 6 months ago. Viewed 132 times 0. Total revenue shown in the AppsFlyer console is significantly larger than the actual revenue. When we review data from a CSV export, we notice. Unity is a flexible and powerful development platform for creating multi-platform 3D and 2D games and interactive experiences. It’s a complete ecosystem for anyone who aims to build a business on creating high-end content and connecting to their most loyal and enthusiastic players and customers. AppsFlyer has always supported Unity.

The Retention Index

Volume Ranking: A ranking of media sources based on the total number of non-fraudulent installs each was attributed for, and, to a lesser degree the number of apps running on the platform

Power Ranking: We normalized and combined the number of non-fraudulent installs, the number of apps running with each media source, and the weighted retention score (see detailed explanation below). We then factored an additional fraud penalty based on the network’s overall fraud rate for the region in question.

Thresholds: A strict threshold policy based on the number of non-organic installs per app, in addition to the number of apps per platform, media source, category and region was applied.

Retention Score

STEP 1: We calculated the non-organic retention rate of each app per media source and per region. We did this separately for days 1,3,7,14,30, dividing the number of users who were active on the day in question by the total number of users who first launched the app in the selected timeframe. We added two longer term signals — week 8 and week 12 post install — dividing the number of users who were active on the week in question by the total number of users who first launched the app in the selected weekly timeframe.

STEP 2: We calculated the organic retention rate of each app on a regional level, separately for each day over 30 days, and for week 8 and week 12.

STEP 3: We then compared the non-organic and organic retention rates for each timeframe. Using organic retention as a benchmark significantly reduces the impact of a given app’s quality, and therefore offers a far stronger indication of a media source’s performance.

STEP 4: We calculated a weighted average using a retention-based logic; the longer a user is retained, the higher the assigned weight. As such, the day 1 non-organic to organic ratio had the least weight, and day 30 & week 12 the most weight. This weighted average serves as our retention score.

STEP 5: We calculated a network’s overall weighted retention score per platform, region and category in question by taking the retention score of each app separately and factoring the number of installs it delivered.

Fraud

Install fraud rate: We divided the number of a network’s fraudulent installs coming from Device Farms and Bots by its total number of attributed installs.

Poaching fraud rate: We divided the number of a network’s fraudulent installs coming from click flooding and install hijacking by its total number of attributed installs.

Overall fraud rate: We divided a network’s poaching and install fraud by its total number of attributed installs.

Clean installs calculation: We reduced the number of fraudulent installs from each network’s overall install count according to its install and poaching fraud rates (the latter is based on stealing organic or non-organic users of other networks and therefore impacts the install count).

Clean retention score calculation: We reduced a network’s retention score according to its poaching fraud rate (most of this fraud is based on stealing organic users, thereby elevating a network’s retention and engagement levels).

Fraud per region: Because the level of fraud differs by region for different media sources, we used the specific fraud rate for each region in question.

Exclusion: Networks that did not meet our overall fraud rate threshold by region were excluded from the Index in question.

The IAP Index

Volume Ranking: A ranking of media sources based on the total number of non-fraudulent installs each was attributed for, and, to a lesser degree the number of apps running on the platform.

Power Ranking: We normalized and combined the number of non-fraudulent installs, the number of apps running with each media source, and the IAP score which is calculated by dividing the non-organic share of paying users by the organic share of paying users. We then factored an additional fraud penalty based on the network’s overall fraud rate for the region in question.

Thresholds: A strict threshold policy based on the number of non-organic installs per app, in addition to the number of apps per platform, media source, category and region was applied.

The IAA Index

Volume Ranking: A ranking of media sources based on the total number of ad impressions, and, to a lesser degree the number of apps running on the platform.

Power Ranking: We normalized and combined the number of non-fraudulent installs, the number of apps running with each media source, and the IAA score. This score is calculated by dividing the amount of ad revenue generated by non-organic users and the amount of ad revenue generated by organic users; in addition, we divided the non-organic IPM (installs per mille) by the organic IPM as an additional factor (although with a smaller weight in the formula than the IAA ARPU ratio). We then factored an additional fraud penalty based on the network’s overall fraud rate for the region in question.

Thresholds: A strict threshold policy based on the number of non-organic installs per app, in addition to the number of apps per platform, media source, category and region was applied.

The Growth Index

We compared the performance of the top 150 media sources in H2 2019 vs. H1 2020. The comparison was calculated by combining a number of factors: install growth, number of apps growth, and growth in share of the app install pie — on a global or regional level.

The Remarketing Index

Appsflyer Unity Software

We factored and normalized the number of attributed remarketing conversions (a conversion occurs when an existing user that has the app installed engages with the remarketing campaign or re-installs the app, and the revenue generated from these conversions (based on all events reported after the remarketing attribution occurs and within its attribution window).

General Notes

Appsflyer Unity Sdk Changelog

- Category groupings were based on the following store categories:

Utility Group: Utilities, Tools, Maps & Navigation, Weather, Photography, Productivity, Video Players

Life & Culture: Entertainment, Lifestyle, Travel, Health & Fitness, Food & Drink, Music, Social, News, Education, Parenting, Books, Dating, House & Home, Beauty, Art & Design, Medical, Communication, Comics, Reference

Gaming Casual Group: Casual, Puzzle, Card, Board, Word, Educational, Trivia, Family, Sports

Gaming Hyper Casual: Apps with at least 90% of revenue coming from ads

Gaming Hardcore: Strategy, Role Playing

Gaming Midcore: Adventure, Simulation, Action, Arcade, Racing

Gaming Social Casino: Casino (not real money) - The global rankings only include media sources with significant activity in at least two of the following regions: North America, Latin America, APAC, Europe and Middle East & Africa.