Click below for the free budget template that matches your lifestyle

Managing household expenses can seem like a scary thing, regardless of whether you’re living on your own with your partner for the first time, or are an experienced homeowner with kids. It’s important to confront your finances and create an effective household budget to help you get a grasp on your finances and limits. Follow these tips to creating an effective budget for your home and family:

1. Get a Clear Idea of Your Spending Habits

Dave Ramsey’s Household Budget Percentages Analysis The idea is to use these budgeting categories as a way to analyze your current monthly budget. As such, the first step to making these budgeting categories useful is to compare them with your actual current spending.

You might have an idea of how much you spend each month, but without cold-hard math, you really don’t have a clear indication of how much money is going out. Many people underestimate how much they spend, which can be a dangerous thing when it comes to keeping household finances in order. The best way to identify this number is to keep each and every receipt from all your expenses, and tally up a total. After adding up these numbers, you’ll have an accurate idea of how much you spend.

- At its most basic, a budget is really just a spending plan for your money. A well-thought-out budget can help you take control of your finances and use your money with purpose rather than spending it haphazardly—a habit than can quickly lead to problems when it’s time to pay the bills each month.

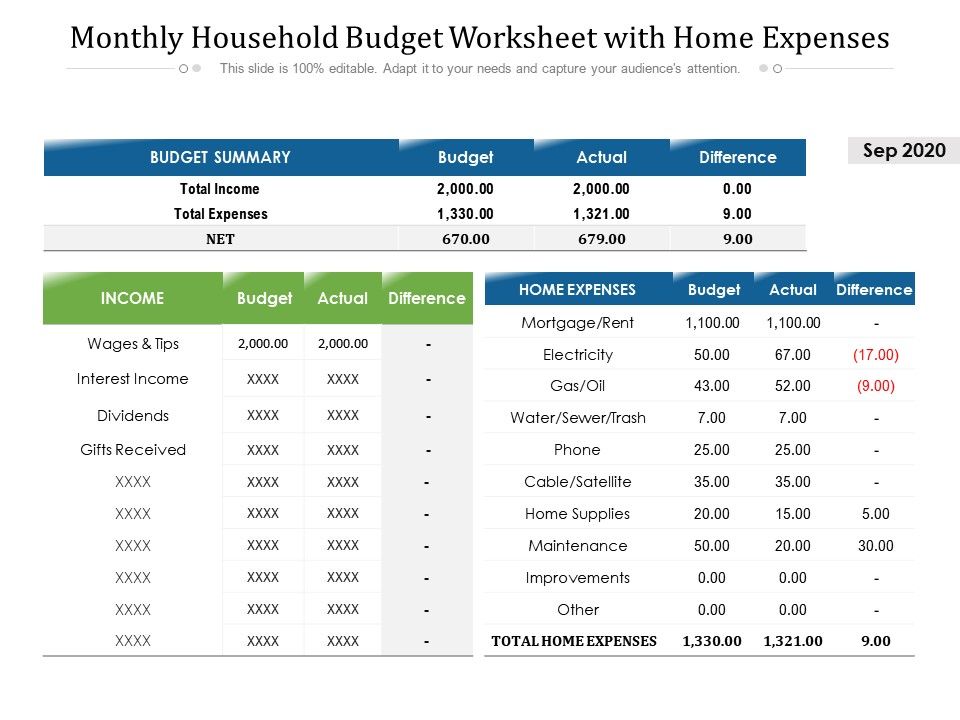

- A home budget is a spending plan that accounts for the income and expenses of a household. To make your home budget, try tallying joint costs in a worksheet.

After subtracting all these expenses from your monthly take-home pay, you’ll see right away if what you earn is adequate enough to cover these costs or not. If you end up with a negative number, you know that you’ve got to make some adjustments.

2. Cut Non-Essential Expenses

After completing step 1, if you find that a negative number is calculated, you are most likely overspending. The simple solution here is much easier said than done – you’ve got to slash your spending. In particular, you need to sacrifice expenses from your “leisure” category, such as dining out, entertainment, non-essential shopping sprees, and so forth.

As tough as this may sound, it’s only a temporary situation that will help lead you to long-term financial stability. Redirect your leisurely funds towards paying off debt, and getting your final number back into the positives.

3. Review and Revise Your Budgeting Tactics

Look over your budget at the end of each month, and identify whether or not any of your habits have changed. This will help you determine whether or not you’re still on track. If you’re not, it’s time to revise your budgeting strategies. Revise certain percentages in your budget, and identify what areas you’re still overspending in.

The whole idea behind budgeting is that it helps you manage your money better on your own terms that you’re most comfortable with. As you get a better grasp of your finances each month, things should change for the better. You’ll be able to set more money aside for things such as investments, an emergency savings account, and so forth.

Click here to download the XLS filehome budget template.xls.

4. Get Some Help From Online Tools

If you’re not too keen on jotting down all your dollars and cents on paper, then try using an effective online tool instead. Using a home budget template in spreadsheet form is a great way to organize your finances so you can clearly see what is coming in and what’s going out.

Need an effective, simple, easy-to-use tool to help keep your household expenses in order? Mint.com has all the solutions you need to keep a budget – and stick to it! Visit Mint.com today and take advantage of our FREE budgeting services and tools!

Sign up for Mint today

From budgets and bills to free credit score and more, you’ll

discover the effortless way to stay on top of it all.

Try our FREE budget calculator

Monthly Income

Housing Expenses

Mortgage

HOA Fees

Rent

Home Insurance

Repairs/Maintenance

Water/Gas/Electricity

Cable/TV/Internet

Phone & Cell

BACKNEXTTransportation Expenses

BACKNEXTEducational Expenses

BACKNEXTFood and Personal

Groceries/Household

Clothing

Entertainment

Medical

Pet Supplies

Other Expenses

BACKNEXT